Bullish breakout and retest for DTM

- Stephen Suttmeier

- Jan 26

- 1 min read

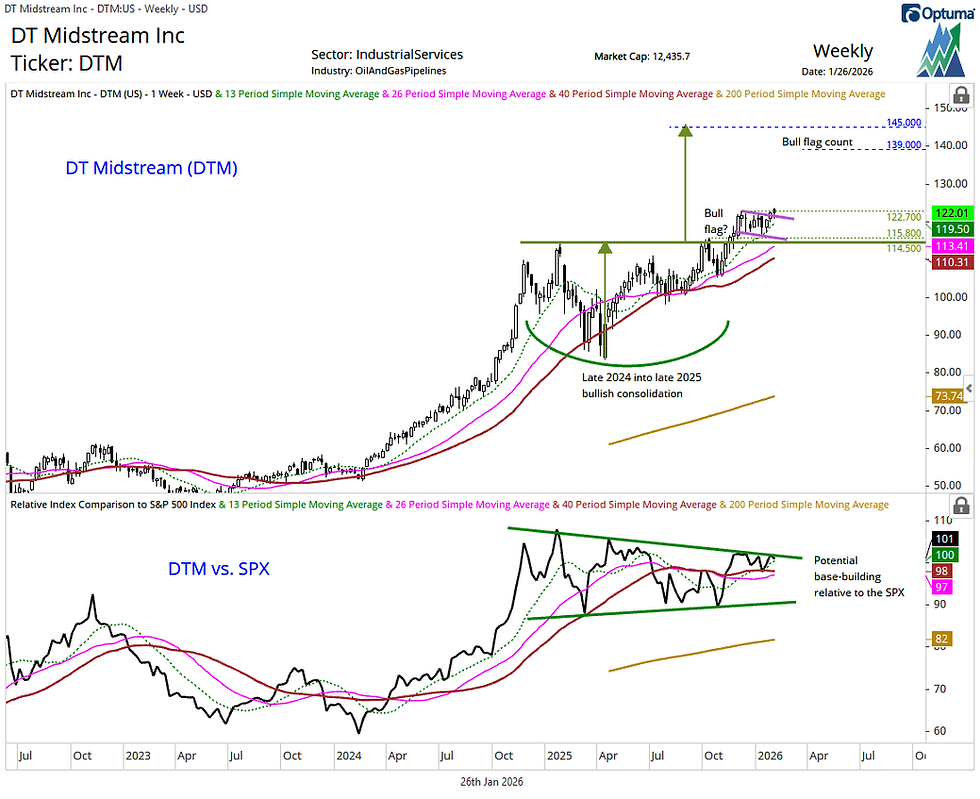

DT Midstream (DTM) has a bullish breakout and retest pattern from a late 2024 into late 2025 bullish consolidation pattern. Holding the 115.80-114.50 zone keeps this breakout intact. Confirming a December into January bullish flag on a rally above the flag neckline near 121.40 and the early December peak at 122.70 would increase conviction. These positive technical setups suggest upside potential to 139 (bullish flag count) and 145 (bullish consolidation pattern target).

Rising 13-, 26-, and 40-week moving averages (WMAs) at 119.50, 113.41, and 110.31, respectively, reinforce the bullish backdrop for DTM.

DTM is trading above its relative price WMAs and could be building a year-long base relative to the S&P 500.

Chart 1: DT Midstream (DTM) (top) and relative to the S&P 500 (bottom)

Comments