CoreWeave (CRWV)

- Stephen Suttmeier

- Jan 15

- 1 min read

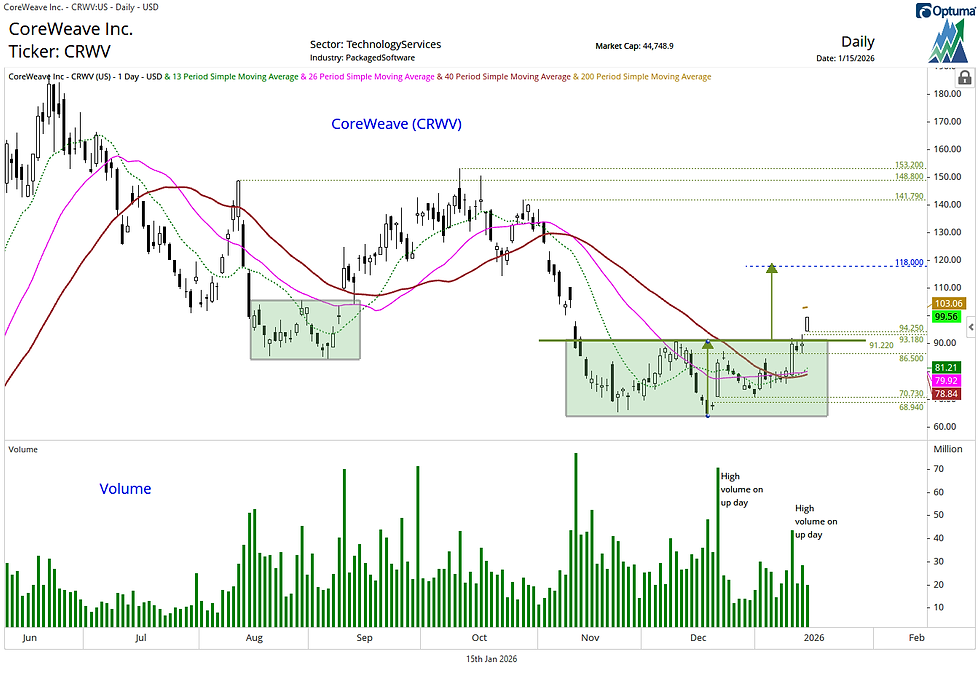

Question: Can you look at CRWV again? I'm wondering if you think it could be forming a head and shoulders bottom.

CoreWeave (CRWV) has gapped higher today with the potential to break out from a November into January bottoming pattern. Holding the gap at 94.25-93.18 would keep the immediate pattern bullish with upside potential to the pattern count at 118 and potentially beyond to the August and October 2025 peaks in the low 140s to upper 140s/low 150s.

Big upside volume days (aka accumulation days) on December 19 and January 12 reinforced this tactical base-building process.

In addition, the upward shift in the daily moving averages (81.21-78.84) support the case for a bullish tactical shift in trend for this stock.

The pattern breakout zone from 91.22 down to 86.50 offers important nearby risk management support on CRWV.

Chart 1: CoreWeave (CRWV) (top) and volume (bottom): Daily chart

Comments