Dow Theory: A confirmed bull market

- Stephen Suttmeier

- Dec 11, 2025

- 1 min read

The traditional Dow Theory, using the Dow Jones Industrial Average and the Dow Jones Transportation Average, generated a buy signal in mid-May, and a new closing-basis high for the Industrials as of Thursday’s (12/11) close confirms the earlier highs on the Transports. This reinforces the primary bull market signal under this version of Dow Theory and provides a bullish backdrop for U.S. equities. The prior bullish confirmation occurred on November 12, when the Transports closed at a new recovery high to confirm the new recovery high in the Industrials.

We flagged the Dow Transports as bullish in this blog on November 25.

Chart 1: Dow Industrials (top) and Dow Transports (bottom)

Bullish Dow Theory confirmation from the S&P 500 and Russell 2000

A new daily closing basis high for the S&P 500 on 12/11 confirms the recent highs on the Russell 2000 (IWM), reinforcing this non-traditional Dow Theory buy signal from mid May.

Chart 2: S&P 500 (top) and Russell 2000 (IWM) (bottom)

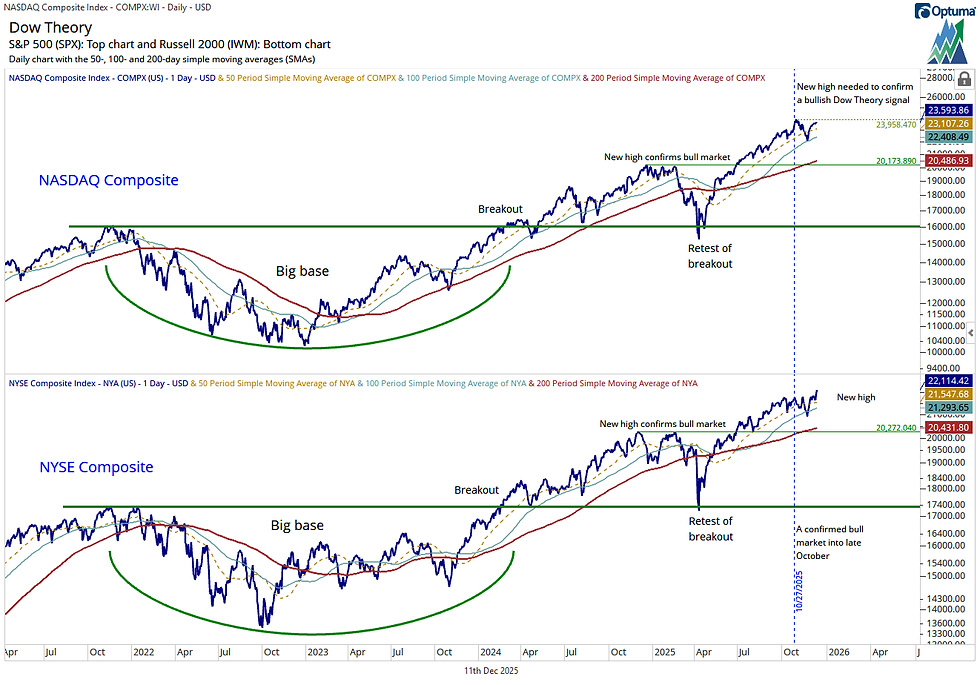

A new closing basis high on the NASDAQ Comp needed for further bullish confirmation

The next step: A new daily closing basis high for the NASDAQ Comp, which would confirm the new closing basis highs for the NYSE Comp. This would reconfirm a primary bull market (aka uptrend) based on this non-traditional version of the Dow Theory.

See our Tech Speak 101 for more on the Dow Theory.

Chart 3: NASDAQ Comp (top) and NYSE Comp (IWM) (bottom)

Great stuff...thanks Steve!