Is META a broken growth stock?

- Stephen Suttmeier

- Jan 16

- 1 min read

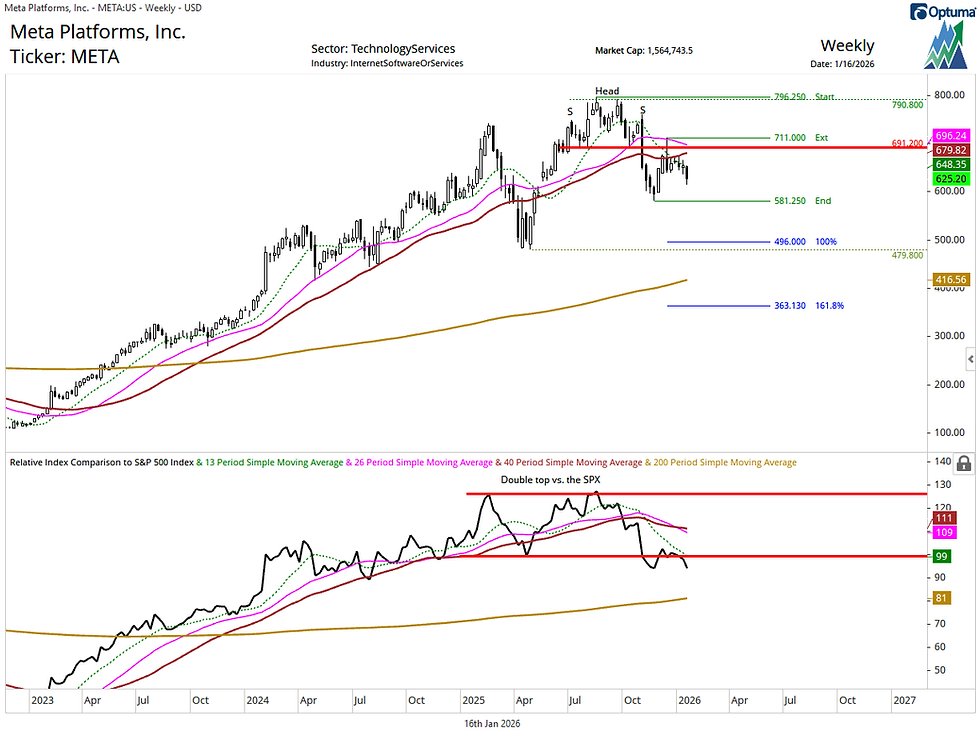

Meta Platforms (META) remains vulnerable on both an absolute price basis and relative to the S&P 500.

While below 691 to 711, the bearish breakdown from a July into August head and shoulders top remains intact with risk back to the late November low at 581.25 and potentially lower toward the 496 (100% extension of the August-November decline projected from the December peak) and 479.80 (April 2025 low). Deteriorating 13-, 26-, and 40-week moving averages from 648 up to 696 reinforce this bearish setup.

Our January 9, 2026, The Chart Check report highlighted a head and shoulders top and loss of leadership for the Magnificent Seven ETF (MAGS) relative to both the S&P 500 (SPY) and S&P 500 equal weight (RSP). META is breaking lower from a double top off its February and August 2025 highs relative to the S&P 500. This could confirm a loss of leadership for this mega cap growth stock.

Chart 1: Meta Platforms (META) (top) and relative to the S&P 500 (bottom)

Good call.