Margin debt rose to $1.06 trillion in August

- Stephen Suttmeier

- Sep 19, 2025

- 1 min read

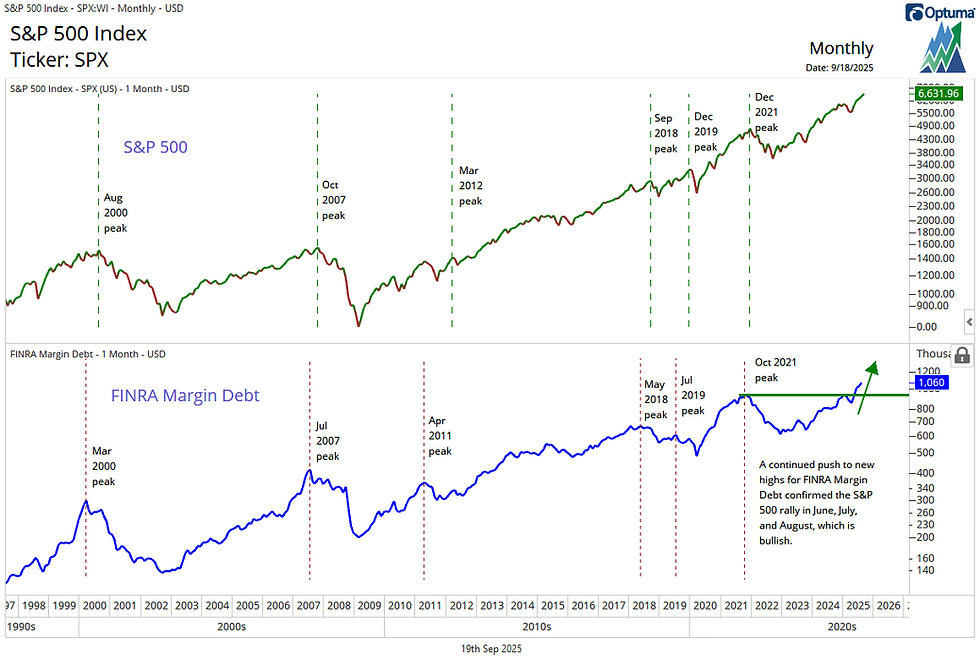

FINRA Margin Debt rose to $1.06 trillion in August, extending its climb after surpassing the $1 trillion threshold for the first time in June. The surge underscores elevated risk appetite and investor confidence—if not outright euphoria.

However, history suggests that rising margin debt has supported bullish trends, not derailed them. Similar concerns about speculative excess emerged between 2013 and 2018, when both margin debt and the S&P 500 consistently advanced to new all-time highs.

The real risk comes when leverage begins to unwind. We would worry if margin debt declined while the S&P 500 continued to rally—a divergence that preceded major peaks in 2000, 2007, 2018, 2019, and late 2021.

Not every divergence is bearish, though. A disconnect between margin debt and the S&P 500 from April 2011 to March 2012 failed to produce a meaningful drawdown.

Chart 1: S&P 500 (top) and FINRA Margin Debt (bottom)

Comments