S&P 500 risk management supports

- Stephen Suttmeier

- Sep 26, 2025

- 1 min read

Updated: Sep 29, 2025

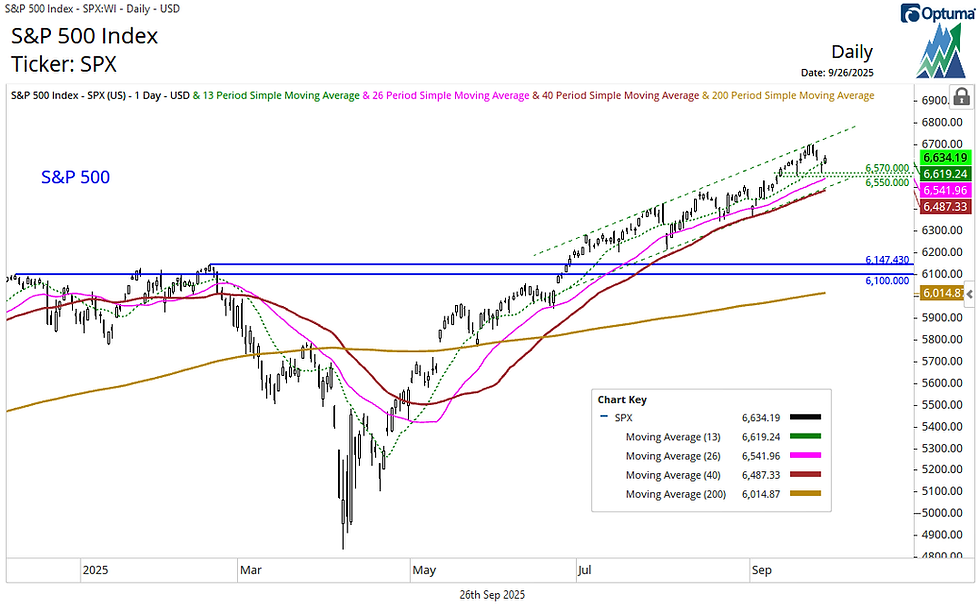

The S&P 500 tested projected channel resistance near 6700 earlier this week before pulling back. Key tactical support is developing at 6570–6550, with the rising 26- and 40-day moving averages at 6542 and 6487, respectively. These levels are critical near-term risk management markers heading into October.

If support holds, the rising channel pattern points to upside potential toward 6800. A failure to hold would open the door for a deeper pullback, though the broader upside breakout remains intact above 6147–6100, reinforced by the rising 200-day moving average near 6000.

Chart 1: S&P 500 with key tactical levels

Comments