TEVA scores a big base breakout

- Stephen Suttmeier

- Nov 19, 2025

- 1 min read

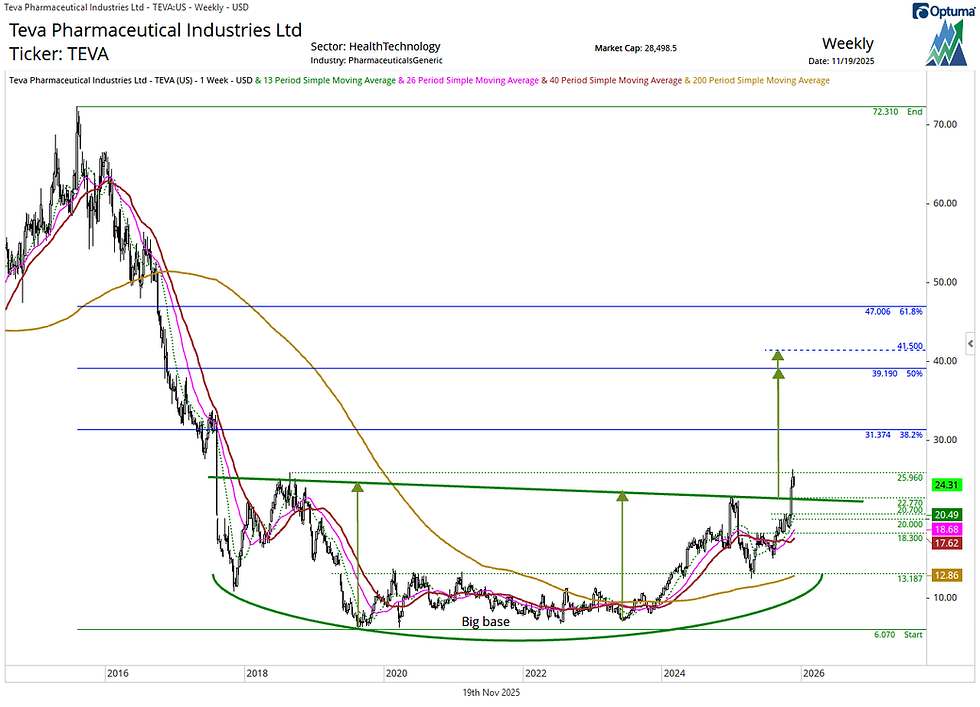

We received a request to take a look at Teva Pharmaceutical (TEVA), which is breaking out from a 2017–2025 big base. This multi-year pattern completion improves the long-term trend profile and sets the stage for additional upside.

Technically, TEVA is bullish above the breakout zone at 22.77–22.50, which now acts as initial support. Holding this area keeps the breakout intact and favors follow-through strength.

This big base pattern favors continued upside beyond the mid-2018 peak at 25.96, with scope for a move toward the 38.2% retracement of the mid-2015 to mid-2019 decline at 31.37. Beyond that, the 50% retracement and base pattern counts cluster in the 39.19–41.50 zone, representing the next major long-term target area. If TEVA remains strong, a rally to the 61.8% retracement near 47 is not ruled out.

Below the breakout point, the 20.70–20.00 area provides additional support along with the 18.30 area. Rising 13-, 26-, and 40-week moving averages from 20.49 to 17.62 converge with and reinforce these supports.

Overall, TEVA’s breakout from an 8-year base is a constructive technical development that highlights meaningful long-term improvement, with a bullish bias while above key supports.

Chart 1: Teva Pharmaceutical Industries (TEVA)

Comments