Upstart Holdings (UPST)

- Stephen Suttmeier

- Sep 23, 2025

- 1 min read

Tactical downside risk from developing bearish continuation pattern

Upstart Holdings (UPST) faces a challenging tactical setup, with risk of breaking lower from an August–September bearish continuation pattern. While below the 26- and 40-day moving averages, which provide an overhang from 66.72 to 68.80, and chart resistance at 71.38-71.55, the tactical setup remains bearish. A decisive breakdown below 62.58–60.54 (200-day MA, pattern neckline, and recent lows) would confirm the continuation pattern and open downside risk to a measured move at 50.15 and the pattern target at 45.50.

Chart 1: Upstart Holdings (UPST): Daily chart

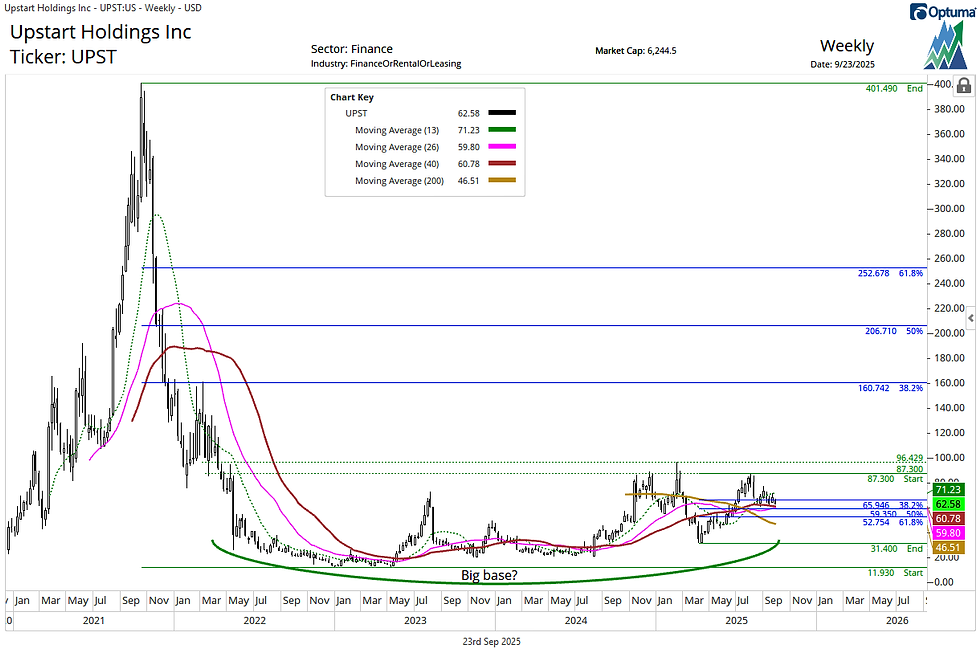

But does UPST have "Big Ugly" base?

Despite tactical weakness, the bigger picture suggests UPST may be forming a large base dating back to mid-2022. The upper end of this structure sits at 87.30–96.43. On a pullback, key Fibonacci retracements of the April–July rally come in at 65.94 (38.2%), 59.30 (50%), and 53.75 (61.8%). With the stock already through the 38.2% level, holding the 59.30–53.75 zone would be constructive for the "Big Ugly" base-building process.

Chart 2: Upstart Holdings (UPST): Weekly chart

Comments