Wells Fargo (WFC) still has room to run

- Stephen Suttmeier

- Jan 5

- 1 min read

We have received a few requests for a technical view on Wells Fargo (WFC).

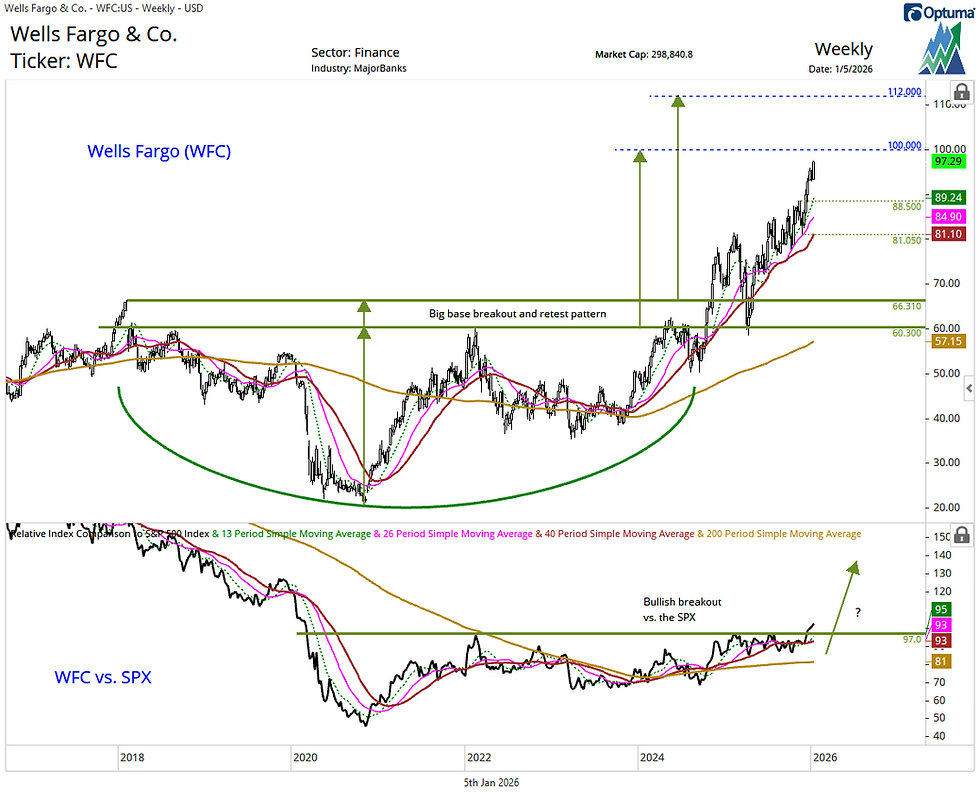

WFC completed a big base dating back to February 2018 on the late 2024 breakout to new all-time highs. The February-April 2025 correction marked a deep retest of this breakout, keeping the overall chart structure constructive.

Although the stock enters 2026 well above its big base breakout points near 66 and 60, it is in position to test upside counts at 100 (for the breakout above 60) and potentially 112 (for the breakout above 66).

The immediate pattern is bullish above the early November peaks near 88.50, with the late November low at 81.05 offering additional support. Rising 13-, 26-, and 40-week moving averages from 89.24 down to 81.10 reinforce the bullish backdrop for WFC.

WFC has also broken higher from a 2020-2025 big base relative to the S&P 500.

Chart 1: Wells Fargo (WFC) (top) and relative to the S&P 500 (bottom)

Comments