top of page

Straight from the Chart

Bullish breakout and retest for DTM

DT Midstream (DTM) has a bullish breakout and retest pattern from a late 2024 into late 2025 bullish consolidation pattern. Holding the 115.80-114.50 zone keeps this breakout intact. Confirming a December into January bullish flag on a rally above the flag neckline near 121.40 and the early December peak at 122.70 would increase conviction. These positive technical setups suggest upside potential to 139 (bullish flag count) and 145 (bullish consolidation pattern target). Ris

Stephen Suttmeier

Jan 26

FCX: 18-year big base breakout potential

Freeport-McMoRan (FCX) is breaking higher from a 2008 into 2026 big base. This view remains firmly in place as long as the stock stays above or defends the breakout zone from 55 down to 51. Under this scenario, pushing above the 2010 and 2008 peaks at 61.35-63.62 would increase confidence in the 18-year big base for FCX with upside targets near 73 (100% extension of the early 2016 to early 2022 advance projected from the mid 2022 low) and then 103-106 (1161.8% extension and

Stephen Suttmeier

Jan 26

Silver surpasses $100 and remains bullish

Silver (XAGUSD) continues to run and has surpassed the upside targets for the "mother of all cup and handle patterns" at 85 and 95. Chart 1: Silver (XAGUSD): Monthly chart with "the mother of all cup and handle patterns" From a tactical perspective, silver has tested an upside target at 108, which is the 100% extension of the rally from the 10/28/2025 low to the 12/29/2025 high projected from the 12/31/2025 low. Staying above this week's opening upside gap at 104.32 to 103.0

Stephen Suttmeier

Jan 26

Sector ETFs Ranks: Cyclicals in the top five

This post highlights the Tactical and longer-term 52-week Ranks for the S&P 500 GICS Level 1 sector ETFs as of the week ending 1/23/2026. Tactical Ranks The Top five Tactical Ranks are Materials, Energy, Healthcare, Industrials, and Discretionary. Cyclicals - Industrials, Materials, Energy - remain in the top five. Two of these sectors - Industrials and Materials - also rank in the top five in terms of the 52-week ranks. Healthcare has shown consistent leadership within t

Stephen Suttmeier

Jan 24

Microsoft (MSFT): Bounce lacks conviction

After a downside gap to start the week, Microsoft (MSFT) rebounded from an intra-week low of 438.68, which was between 50% and 61.8% retracements of the April–July rally at 450 and 425, respectively. However, the recovery failed to produce a bullish weekly candlestick signal. Instead, the weekly chart registered a bearish thrusting line, with the stock closing below the midpoint of the prior week’s down (black) real body. This suggests limited conviction in a tactical low an

Stephen Suttmeier

Jan 23

Capital One (COF) pullback tests key support

We previously highlighted a constructive technical setup for Capital One (COF) pointing to upside beyond 230 and toward a bullish pattern count at 268 ( Straight from the Chart posts dated August 28 and October 17, 2025). Since then, the stock has come under near-term pressure. COF formed a weekly shooting star (week of 1/9), followed by a weekly downside gap (week of 1/16) and has had continued downside follow-through so far this week. Shares are testing the rising 26- and

Stephen Suttmeier

Jan 23

Time to go log scale on Peru (EPU)?

We highlighted the iShares MSCI Peru ETF (EPU) as bullish in our July 16, 2025 The Stock Pulse . EPU has since melted up, exceeding pattern counts at 72.00 and 84.50. Last week's upside gap at 79.29-78.45 provides a risk management level. Chart 1: iShares MSCI Peru ETF (EPU): Weekly chart Is it time to go "log scale" on EPU? The logarithmic scale chart tells us what is possible on a longer-term basis and shows additional upside potential toward big base pattern counts at 11

Stephen Suttmeier

Jan 23

Argentina (ARGT) is breaking out

The Global X MSCI Argentina ETF (ARGT) is attempting to break out from a November 2025–January 2026 triangle within a broader May 2025–January 2026 basing pattern. The setup remains bullish above 96–95, reinforced by rising 13-, 26-, and 40-day moving averages clustered at 93.64–92.14. A confirmed breakout would target 105.70 (triangle objective) with potential follow-through toward 125 (larger base target). If needed, the January MTD lows at 90.20–89.77 define an additional

Stephen Suttmeier

Jan 23

CRDO has very challenging technicals

Credo Technology Group (CRDO) faces a challenging technical backdrop. The stock developed a broadening trading range from September into December 2025, accompanied by an early December bearish shooting star candle and an upside exhaustion gap. These signals, combined with a potential September 2025–early 2026 relative top versus the S&P 500, suggest a loss of upside momentum. While the lower end of CRDO’s trading range and the 50% retracement of the April–December rally at 1

Stephen Suttmeier

Jan 22

GAP set up for 2-year base breakout

The Gap (GAP) is forming a potential basing pattern from early 2024 into early 2026, suggesting a constructive longer-term setup. We maintain confidence in this developing bullish structure while price holds above chart support at 24.78–24.54, which is reinforced by rising 26- and 40-week moving averages near 23.74–23.37. A decisive rally above the neckline zone at 28.58–29.29 would confirm this 2-year bullish consolidation and imply further upside beyond 30.75–31.53 (the Ju

Stephen Suttmeier

Jan 22

INTC is breaking out with confirming volume

There has been increased subscriber interest in Intel Corp. (INTC) following the stock’s strength this week. From a technical perspective, INTC appears to be breaking out, with bullish confirmation from the volume advance–decline indicator. Sustaining this week’s move above 51.28 (the December 2023 peak) would reinforce the breakout and argue for continued upside. Initial upside potential targets 57.70, which represents the 100% extension of the April–October 2025 rally pro

Stephen Suttmeier

Jan 22

Constellation Energy (CEG)

Constellation Energy (CEG) has invalidated the breakout from the bullish cup-and-handle pattern highlighted in this blog on November 20, 2025, and previously discussed in the September 13, 2025 The Stock Pulse . So now what? The breakdown below the neckline at 352, the early November higher low at 324, and the zone of the rising 13-, 26-, and 40-week moving averages (WMAs) from 326 to 347 invalidates the bullish cup-and-handle setup. Former support has now shifted to resista

Stephen Suttmeier

Jan 22

Mind the gap on the S&P 500

The S&P 500 (SPX) has turned sloppy entering 2026. Despite starting the year with solid breadth, the index failed to sustain a breakout from a late October through late December / early January bullish consolidation pattern. “To tariff, or not to tariff, that is the question.” Volatility tied to President Trump’s rhetoric around tariffs and a potential deal involving Greenland dominated the past two sessions. Tuesday’s (1/20) sharp selloff and Wednesday’s (1/21) equally shar

Stephen Suttmeier

Jan 22

Teledyne (TDY) breaks out

Question: Thoughts on TDY here post earnings? Could we be working on another breakout? Thanks Yes, Teledyne Technologies (TDY) has broken out following today’s post-earnings upside gap. The gap higher completes an early-October to late-January base, and the move is constructive from both a price and volume perspective. Holding above the prior early-October high near 596, and more importantly above the high-volume upside gap zone from 592 down to 580, would keep this bullish

Stephen Suttmeier

Jan 21

Baker Hughes (BKR) breaking out again

Question: Steve, any thoughts on BKR are most welcome. Thanks, as always. Baker Hughes (BKR) remains bullish with a breakout and deep retest pattern from a big base that formed between mid 2017 and late 2024. This big base pattern projects further upside to 55 and 66 (November 14, 2025, The Stock Pulse ). BKR also has a breakout and retest from a February-September bullish consolidation that projects to 59. Holding the 46.70 to 43.90 range keeps the immediate pattern bullish

Stephen Suttmeier

Jan 21

IBM: Stalls after testing long-term target zone

We have some interest in International Business Machines (IBM) . We continue to monitor IBM , which is at an important technical juncture after testing and stalling near a long-term upside objective in the 310–325 range. This target was derived from the 2012–2024 base breakout, and the lack of sustained follow-through at this level raises the need for a clearer directional signal. This test of long-term resistance has coincided with a mid-to-late 2025 bearish divergence in IB

Stephen Suttmeier

Jan 21

S&P 500 gaps lower on Trump tariff threat

Another round of tariff rhetoric from President Trump pressured U.S. equities, pushing the S&P 500 (SPX) sharply lower. The SPX gapped down 2.1% on Tuesday, January 20 following a tariff threat aimed at eight European nations tied to a Greenland-related deal. The selloff drove the index decisively below its 13-, 26-, and 40-day moving averages (DMAs) at 6916–6852, leaving behind a large downside gap. This gap, spanning roughly 6871 to 6925, is likely to act as near-term over

Stephen Suttmeier

Jan 20

Chile (ECH): Bullish potential to 54-56

The iShares MSCI Chile Index Fund ETF (ECH) broke out from a 6-year basing pattern on the late 2025 rally above 35.92. ECH quickly rallied to test and trade beyond the 38.2% retracement of the 2010-2020 decline at 41.55, with additional upside potential to 48.96 (50% retracement), and then into the 54.00-56.38 area (late 2019-late 2025 bottoming pattern target and 61.8% retracement). Rising 13-, 26-, and 40-week moving averages from 39.26 down to 35.97-34.38 reinforce this b

Stephen Suttmeier

Jan 20

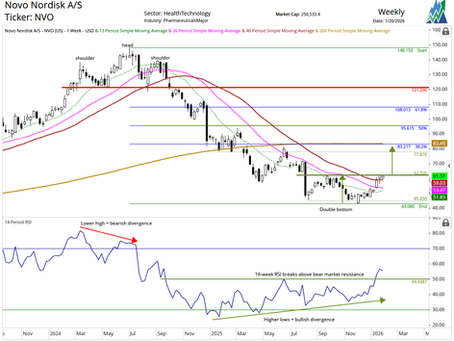

Potential double bottom for NVO

We received a request for Novo Nordisk A/S (NVO) . NVO may be forming a tactical double bottom from its August and November 2025 lows near 45-43. Higher lows throughout 2025 on intermediate-term price momentum as measured by the 14-week RSI set up a positive divergence against the lower lows on the stock, supporting the case this potential double bottom. The early 2026 breakout above bear market resistance just below 50 on the RSI provides a potential bullish leading indicat

Stephen Suttmeier

Jan 20

Base-building for ARKG

Question: ARKG is improving, is it ready to breakout? Thank you. Yes, the ARK Genomic Revolution ETF (ARKG) is improving and position for a future breakout from a basing/bottoming pattern dating back to late 2023. In addition, ARKG shows bottoming signs relative to the S&P 500 from late 2024 into early 2026. Breaking out from this pattern would continue ARKG's leadership trend from May 2025. Holding above or within the zone of improving weekly moving averages from 29.98-28.4

Stephen Suttmeier

Jan 20

bottom of page