top of page

Straight from the Chart

SMH remains bullish - absolute and vs. SPX

The VanEck Semiconductor ETF (SMH) broke higher from the bullish cup and handle pattern highlighted in our December 29, 2025, The Sector Edge . This bullish breakout remains firmly intact above 375-372, and SMH still has upside potential to the patten counts at 398 and 430. SMH remains within strong absolute and relative price trends with new absolute price highs confirmed by relative price highs as well as by maximum positive absolute and relative trend scores trend scores.

Stephen Suttmeier

Jan 12

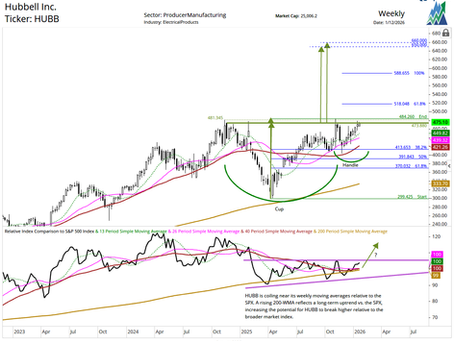

HUBB: Bullish cup and handle breakout watch

We highlighted Hubbell Inc. (HUBB) in our November 7, 2025, The Stock Pulse . HUBB struggled into late November prior to strengthening into early 2026. This sets up HUBB for a bullish breakout from a late 2024 into early 2026 bullish cup and handle. A decisive rally above 473-484 would confirm this bullish pattern for upside initially to 518 (61.8% extension of the rally from the cup low (299) to the handle high (484) projected from the handle low (403)) and then higher to 5

Stephen Suttmeier

Jan 12

ZION attempts a bullish breakout

We received a request on Zions Bancorporation (ZION) . ZION is attempting a bullish breakout from a late 2024 into early 2026 basing pattern. A decisive push above the 59.40 to 63.22 area would confirm this bullish setup and set the stage for a rally to 66.27 (100% extension of the April-September 2025 rally projected from the mid October low) initially and then higher toward 75.44 (early 2022 peak) to 78-79.50 (161.8% extension and basing pattern target). Rising 13-, 26-, an

Stephen Suttmeier

Jan 12

S&P 500 GICs Level 1 sector ETFs Ranks

This post highlights the Tactical and 52-week Ranks for the S&P 500 GICS Level 1 sector ETFs as of the week ending 1/9/2026. The Top five Tactical Ranks are Materials, Healthcare, Consumer Discretionary, Industrials, and Technology. Communication Services dropped out of the top five, replaced by Discretionary, which ranks at third from eighth in the prior week. Materials jumped to first from fifth, unseating Healthcare from the top slot. However, Healthcare leadership als

Stephen Suttmeier

Jan 10

Leidos (LDOS): Cup and Handle

We have some interest in Leidos Holdings (LDOS) , which is another stock that is trading within a potential late 2024 into early 2026 bullish cup and handle formation. LDOS is firmly bullish above support from 189 down to 178 (13- and 26-week moving averages (WMAs) and chart levels), which could mark the handle low. If needed the rising 40-WMA near 172 offers an additional support ahead of the 162 area, which is the neckline of the December 2024 to July 2025 head and shoulde

Stephen Suttmeier

Jan 9

SharkNinja (SN): Cup and handle

Question: What is your read on SN chart? Are we at a potential breakout point near 120-122? Thanks Steve SharkNinja (SN) is building an early 2025 into early 2026 cup and handle pattern. A decisive breakout above the 121.81-123.00 to 128.51 area is the catalyst needed to confirm this bullish setup and suggest further upside to 151 (100% extension of the rally from the cup low (60.50) to the handle high (128.51) projected from the handle low (83.12)) and 183 (cup and handle p

Stephen Suttmeier

Jan 9

Alphabet (GOOGL) looks solid

While today's (1/9/2026) The Chart Check report highlighted the risk of a head and shoulders top for the Magnificent Seven ETF (MAGS) relative to both the S&P 500 (SPY) and S&P 500 Equal Weight (RSP), the chart pattern and technical setup for Alphabet (GOOGL ) remains solid. We last covered GOOGL in this blog on October 30, 2025. The stock achieved the tactical targets at 292-297 and is approaching a longer-term projection at 161.8% extension level near 340. Unlike the MAGS

Stephen Suttmeier

Jan 9

Three financials: C, JPM, and SF

Subscribers have asked about Citigroup (C), JPMorgan (JPM), and Stifel Financial (SF) . We last highlighted Citigroup (C) in Straight from the Chart on October 16, 2025, and suggested that a big base breakout favors upside on the stock to 114 and 128. C has achieved the 144 area and is closing in on the 128 area. C remains within its leadership trend relative to the S&P 500 that began in late 2023. Chart 1: Citigroup (C) (top) and relative to the S&P 500 (bottom) The daily

Stephen Suttmeier

Jan 9

Estee Lauder (EL): Breaks out from a bottom

We received a question on Estee Lauder (EL) , which we have been monitoring as a Staples stock that is bucking the sector’s broader technical weakness We view absolute price strength confirmed by rising relative strength versus the S&P 500 as bullish , and EL enters 2026 with both absolute and relative breakouts from a mid-2024 into late-2025/early-2026 bottoming pattern. Holding the 104–100 support zone, reinforced by the rising 13-week WMA, would keep the breakout firmly in

Stephen Suttmeier

Jan 9

A potential breakout and retest for BABA

We received a request to update the technicals for Alibaba (BABA) , which we last covered in our Straight from the Chart blog on November 11, 2025. In summary, BABA has the potential to confirm a bullish breakout and retest pattern that is similar to the bullish setups on both the Invesco China Technology (CQQQ) and SPDR S&P China (GXC) ETFs. BABA has corrected lower from early October to retest the breakout from an early 2022 into late 2025 big base pattern. This corrective

Stephen Suttmeier

Jan 8

Roper (ROP): Bearish pennant after a big top

Question: Can I get your view on ROP chart... pretty sure what your response will be but always helpful to have the chart view and your thoughts. Thanks Steve. Roper Technologies (ROP) lost its leadership status relative to the S&P 500 (SPX) after topping out versus the broader U.S. equity market in late 2023. A December 2023-April 2025 relative price bearish divergence followed by an August 2025 breakdown vs. the SPX preceded the breakdown from a late 2023 into late 2025 ab

Stephen Suttmeier

Jan 8

Financial conditions enter 2026 as a tailwind

2026 is the mid-term year and the weakest year of the 4-year U.S. Presidential Cycle for the S&P 500 (SPX). In our view, the Chicago Fed National Financial Conditions Index (NFCI) is an important macro indicator to watch in 2026. Table 1: S&P 500 returns during the Presidential Cycle and all years: 1928-2025 The Chicago Fed National Financial Conditions Index (NFCI) turned lower from mid-2021, creating a major negative divergence for U.S. equities entering the last mid-term

Stephen Suttmeier

Jan 8

UAMY breaks higher from a H&S bottom

W e received a question on United States Antimony (UAMY). UAMY is an American rare earths / critical minerals stock that is breaking higher from a late November 2025 into January 2026 head and shoulders (H&S) bottoming pattern with bullish confirmation from both the volume advance decline and on balance volume indicators. Sustaining the break above the H&S bottom neckline at 6.95 would keep the immediate pattern bullish with upside potential to the pattern count at 9.60 and

Stephen Suttmeier

Jan 8

Amazon (AMZN) is firming up

We have some interest in Amazon (AMZN) . We recently highlighted AMZN in Straight from Chart on December 3 and compared its chart pattern to that of Walmart (WMT) . We suggested that if AMZN can continue to hold its zone of rising WMAs, its setup would resemble WMT’s choppy bullish turn higher out of its cup and handle pattern. In our view, this bullish shift appears to be happening for AMZN entering 2026. Amazon (AMZN) broke out from a bullish January–October cup and handl

Stephen Suttmeier

Jan 7

A challenging setup for Home Depot (HD)

Question: Can I get your thoughts on the HD chart? Thanks Steve Home Depot (HD) has a challenging chart pattern in our view. Taking a step back and looking at the monthly chart reveals a big topping pattern for HD relative to the S&P 500 (SPX) that provides a major risk for the absolute price chart. In addition, HD broke below its 40-month moving average versus the SPX in February 2023 and has remained below that longer-term moving average ever since. The stock's absolute pr

Stephen Suttmeier

Jan 7

Solid confirmation from net new highs

The S&P 500 reached a new all-time high yesterday (1/6/2026). The spread between 52-week highs and 52-week lows moved to a cycle high at 54 to confirmed both this new high and the rally from the April 2025 low. Ideally, the spread between new highs vs. new lows continues to improve with room to run to levels achieved on the rally from late 2023 into early 2025 in the 95 to 124 range. Chart 1: S&P 500 (top) and the spread between 52-week highs and 52-week lows with the 10-day

Stephen Suttmeier

Jan 7

India ETFs remain within basing patterns

Question: Can you look at the India market? We highlighted that both the iShares India ETF (INDA) and the Wisdom Tree India Earnings Fund (EPI) were setting up for bullish breakouts in our October 28, 2025, Charted Market Insights . Since then, INDA and EPI have made little progress, but these basing patterns remain intact with the potential for upside breakouts in early 2026. The iShares India ETF (INDA) is building a late 2024 into early 2026 basing pattern within its lo

Stephen Suttmeier

Jan 7

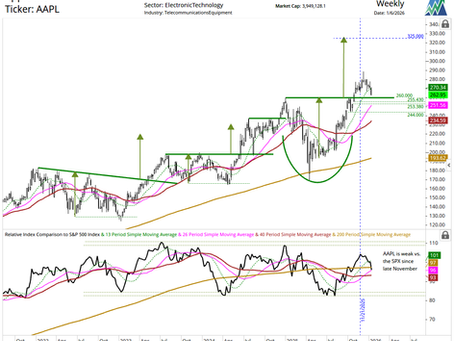

AAPL is struggling, so watch supports

Question: Any chance I can get a look at an AAPL chart? Is 260 level a firm support level? We flagged Apple (AAPL) in Straight from the Chart on October 24, citing a gap up and break out above 260 that confirmed a late 2024-late 2025 basing pattern with upside potential to 325. However, AAPL has not had much follow-through after this breakout and has lost leadership relative to the S&P 500 (SPX) since late November. In addition, AAPL shows risk from a late October into earl

Stephen Suttmeier

Jan 6

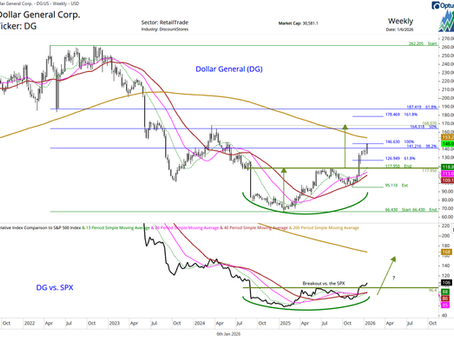

Dollar General (DG) on the move

Question: Could you please take a look at DG? Dollar General (DG) is bullish and has broken out on both an absolute price basis and relative to the S&P 500 (SPX). The rally above 117.95 completed an August 2024-December 2025 basing pattern, which was confirmed by a similar breakout for DG vs. the SPX. The absolute price breakout has surpassed 126.95 (61.8% extension of the January-August 2025 rally projected from the early November low) to test the next target area at 141.22

Stephen Suttmeier

Jan 6

RNR builds a base for 350

We receive a request to look at the chart for RenaissanceRe Holdings Ltd (RNR) . RNR sets up bullishly and is building a late 2024 into early 2026 base that could mark a bullish continuation pattern within the stock's longer-term uptrend. A decisive breakout above the 285 area would confirm this pattern and suggest upside beyond the late 2024 spike highs at 290.78 and 300 toward the basing pattern count at 350. Until that breakout occurs, the rising 13-, 26-, and 40-week movi

Stephen Suttmeier

Jan 6

bottom of page