top of page

Straight from the Chart

Kicking the tires on Harley-Davidson (HOG)

We receive a request to review the chart of Harley-Davidson (HOG). HOG tilts bearish . The weekly downside gap for the week ending December 12th at 23.19-23.29 provides a potential overhang for HOG, which is at risk to break its April 2025 low at 20.45 and potentially test its 2020 COVID-19 low at 14.31. The deteriorating 13-, 26-, and 40-week moving averages from 24.73 to 25.79 also provide an overhang and offer additional resistance along with a broken higher low from early

Stephen Suttmeier

Dec 23, 2025

Two bullish banks: PNC and TFC

The Financials have had a breadth of bullish setups that we have highlighted in our The Stock Pulse report and in this blog including Affiliated Managers (AMG), Bank of America (BAC), Bank of New York Mellon (BK), Capital One Financial (COF), Citigroup (C), Citizens Financial (CFG), First Bancorp PR (FBP), Hanmi Financial (HAFC), Lemonade (LMND), Nasdaq (NDAQ), Nu Holdings (NU), Principal Financial (PRG), Rocket Companies (RKT), and State Street (STT). This post highlights

Stephen Suttmeier

Dec 23, 2025

Bullish setups for GD, LHX, and NOC

General Dynamics (GD), L3Harris Technologies (LHX), and Northrop Grumman (NOC) remain bullish aerospace and defense stocks. A late 2024 into mid 2025 bullish consolidation pattern favors further upside to 395 on General Dynamics (GD) . After the stock rallied and tested its 100% extension of the mid 2023-late 2024 rally projected from the April 2025 low at 353.75 in late October, it formed a falling (aka bullish) wedge. Sustaining the breakout from this pattern would keep t

Stephen Suttmeier

Dec 22, 2025

UBER at risk while below 81.51-83.62

While below the 81.51 to 83.62 area, Uber Technologies (UBER) is at risk for a sustained breakdown from a May-December topping pattern that would suggest deeper downside into the low 60s (pattern count and chart supports) and potentially toward 57-54 (rising 200-week moving average and August 2024 low). If UBER stabilizes and reclaims its broken support, the pattern would shift back to range-bound vs. toppy with resistance from 87.94 (40-week moving average) to 91.18-93.60 (

Stephen Suttmeier

Dec 22, 2025

Gold breaks above 4400

Gold futures are breaking above 4400 this morning, placing the focus on a test of bullish flag and tactical base breakout counts at 4500 and 4600. In addition, sustaining the move above 4400 would suggest even more tactical upside toward 4890 on gold. Holding above 4400-4369 would keep the immediate pattern bullish. The 4300 to 4250 range offers an additional chart support. Sustaining this tactical bullish setup for gold futures would bode well for the bullish breakouts for

Stephen Suttmeier

Dec 22, 2025

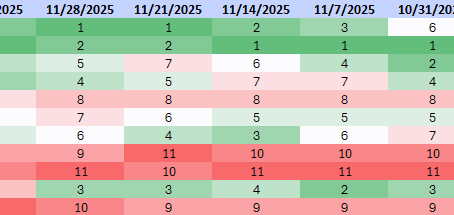

S&P 500 GICS 1 Sector ETF Ranks

This post highlights the Tactical and 52-week Ranks for the S&P 500 GICS Level 1 sector ETFs as of the week ending 12/19/2025. The top five Tactical Ranks remain Healthcare, Technology, Consumer Discretionary, Communication Services, and Financials , unchanged from the prior week. Technology continues to stand out, ranking either first or second in 10 consecutive weeks and remaining the only sector to hold a consistent top five tactical position over that period. The botto

Stephen Suttmeier

Dec 20, 2025

Pharma: Bullish setups for AZN and LLY

Both AstraZeneca (AZN) and Eli Lilly (LLY) have broken out from mid 2024-late 2025 bullish consolidation basing patterns and show additional upside potential after a near-term dip back toward their breakout points. These patterns resemble the bullish setup for the VanEck Pharmaceutical ETF (PPH) that we highlighted in our November 17 The Sector Edge . The bullish breakout for AstraZeneca (AZN) remains in place above 87.63-86.57 (breakout levels) and 85.84-85.15 (the mid N

Stephen Suttmeier

Dec 19, 2025

Carnival (CCL): Big base breakout watch

Carnival Corp. (CCL) is in position for an upside breakout from a big base dating back to the 2020 COVID-19 pandemic low. We highlighted the bullish potential for CCL in the Straight from the Chart blog on both October 17 and September 12, but the pattern has taken additional time to develop. CCL has the potential to break out from a big base. A decisive rally above 31.50-32.80 (38.2% retracement of the 2018 to 2022 decline and September high) is required to confirm the big

Stephen Suttmeier

Dec 19, 2025

U.S. Treasury Yields across the curve

This post updates our charts and technical views on the U.S. 30-year Treasury yield (TYX), 10-year Treasury yield (TNX), 5-year Treasury yield (FVX) , and 2-year Treasury yield (2YCMY.X) . In summary, TYX's breakout from a head and shoulders bottom suggests upside risk to 5%, the TNX and FVX have backed up to test falling 26- and 40-week moving averages as resistances, and the 2-year yield consolidates within a tight range and remains tilted to the downside. These setups have

Stephen Suttmeier

Dec 19, 2025

Invesco CurrencyShares Japanese Yen Trust (FXY)

Question: Can you speak to the Yen vs the Dollar as Japan raises rates? Could you look at FXY? Thanks. Markets are pricing in and widely expecting the Bank of Japan (BOJ) to hike interest rates at its policy meeting concluding on Friday, December 19, 2025. In theory, the Japanese Yen should strengthen on a BOJ rate hike, as higher policy rates lift yields on yen-denominated assets and help narrow the interest-rate differential versus the U.S. and other higher-yielding currenc

Stephen Suttmeier

Dec 18, 2025

Bullish setups for AMR and RIO

We received a request for technicals on Alpha Metallurgical Resources (AMR) and Rio Tinto (RIO) . Both stocks have bullish patterns that point to more upside. Alpha Metallurgical Resources (AMR) is coming out of a February-December basing pattern. Sustaining this week's rally above the 196 to 187 area (rising 200-week moving average and pattern neckline) would support this view with upside potential to the retracement levels for the March 2024 to June 2025 decline at 232-23

Stephen Suttmeier

Dec 18, 2025

Weekly seasonality turns positive for equities

Weekly seasonality for the S&P 500 (SPX) going back to 1950 flips bullish this week and remains positive into the first week of January. If today's rally continues in accordance with this stronger pattern for seasonality, it would bode well for the developing bullish cup and handle on the SPX from late October that we have highlighted in this blog, research notes, and on the Charted Line Webinar. Chart 1: S&P 500: Average weekly returns: 1950-2025 The Dow Jones Industrial Av

Stephen Suttmeier

Dec 18, 2025

TIP vs. AGG: Sideways-to-lower inflation expectations

The Consumer Price Index (CPI) rose to 2.7% year-over-year in November, which was well below the consensus of 3.1% heading into the print and a softer than the +3.0% reading in September. Prior to this morning's CPI numbers, the iShares TIPS Bond ETF (TIP) relative to the iShares Core U.S. Aggregate Bond ETF (AGG) suggested sideways-to-lower inflation expectations. The recent breakdown in the TIP/AGG ratio suggests that expectations for inflation should drop back down to t

Stephen Suttmeier

Dec 18, 2025

MU: Key levels heading into earnings

Micron Technology (MU) is scheduled to report earnings today (12/17/2025) after the close. MU is under pressure after its push to a new high at 264.75 on December 10 did not hold. Today's weakness has breached the 50% retracement of the November 21 to December 10 rally near 228 with the 61.8% retracement near 220 and the rising 13-week (quarterly) moving average at 215 the next tactical levels to watch ahead of bigger support at the late November higher low at 192.59 and the

Stephen Suttmeier

Dec 17, 2025

Margin debt to another record high

FINRA margin debt (aka debit balances in customers' securities margin accounts) reached a new record high of $1.214 trillion in November, marking its sixth consecutive record high since crossing above the $1 trillion threshold in June. The late 2021 to mid 2025 cup and handle pattern supports the case for margin debt to reach $1.260 trillion. Chart 1: FINRA margin debt Source: FINRA The surge in margin debt reflects growing risk appetite and investor confidence, but investor

Stephen Suttmeier

Dec 17, 2025

Levels to watch on SPX, NDX, and Crude Oil

This post provides quick technical hits for the S&P 500, NASDAQ 100, and WTI Crude Oil . The S&P 500 (SPX) is holding tactical support on its daily Bollinger Bands chart (Nov 28 The Chart Check ) defined by the rising 20-day moving average (center line of the Bollinger Bands) and at 6783 and previous resistance at 6775-6765 as the index traces out a potential late October into December bullish cup and handle pattern. If completed on a breakout to new highs, the cup and hand

Stephen Suttmeier

Dec 17, 2025

LUV has rallied out of a big base

Southwest Airlines (LUV) has rallied out of a 3-year big base on the move above 38.27-37.96 (38.2% retracement of the 2021-2023 decline and mid 2025 peak) to test the 50% retracement at 43.33. Dips that hold above or near the 38-37 area keep the big base breakout intact and pattern bullish for LUV with additional upside potential to 48.38 (61.8% retracement) and 54 (pattern count). LUV is attempting to break out from a mid 2024 into late 2025 bottoming pattern relative to th

Stephen Suttmeier

Dec 16, 2025

A look at NXP Semiconductors (NXPI)

We received a question on NXP Semiconductors (NXPI). NXPI has been a laggard but one that has improved in recent weeks after defending the 61.8% retracement of the April to August rally at 183.74 in late November. Holding the strengthening weekly moving averages, 38.2% retracement, and a chart levels from 218.85 down to 203.24 would suggest a more constructive pattern that resembles the setup from late 2022 into early 2023. If the 218-203 area holds, the potential would buil

Stephen Suttmeier

Dec 16, 2025

Big bases for NEM, PAAS, and SVM

We flagged the potential for a massive base on Newmont Corp (NEM) in this blog on September 11 along with bullish setups for Agnico Eagle Mines (AEM), Compania de Minas Buenaventura S.A.A (BVN), Fortuna Mining (FSM), and Silvercorp Metals (SVM) . Pan American Silver (PAAS) also has a big base. We address NEM, PAAS, and SVM below. Newmont Corp (NEM) has broken out from its massive 38-year big base and tested a measured move target at 100. However, while above the 86-82 ar

Stephen Suttmeier

Dec 16, 2025

Iberdrola S.A. (IBDRY): Big base breakout

We received a question on Iberdrola S.A. (IBDRY) , an ADR for an electric utilities company based in Spain. IBDRY broke out from a massive cup and handle big base dating back to mid 2008 earlier this year and has since achieved new highs above the prior peak from November 2007 at 72. This is a longer-term bullish setup. IBDRY has tested the first target area from 84 to 88, which is 100% extension of the rally from the mid 2012 cup low to the early 2021 handle peak projected f

Stephen Suttmeier

Dec 15, 2025

bottom of page