top of page

All Posts

The Chart Check - Nov. 28, 2025

*** Please see the bottom of this report for important disclaimers and disclosures.*** December stronger after a lackluster November SPX seasonality scenarios: A lackluster November bodes well for December With a positive hit rate of 73%, December is the month of the year that the S&P 500 (SPX) is most likely to trade higher. The average and median SPX returns for December going back to 1928 are 1.28% and 1.49%, respectively. The SPX was up 0.13% in November 2025 vs. the ave

Stephen Suttmeier

Nov 28, 2025

Copper: Bullish breakout watch

Similar to silver futures (see recent Straight from the Chart posts), copper futures are also breaking higher today. If copper futures sustain today's (11/28) rally above 5.28-5.26, it would confirm an early October into late November bullish continuation pattern with upside potential to 5.63-5.70. The 5.16-5.13 area (November 13 high and today's session low) offers support if copper struggles with this potential bullish breakout. Rising 13-, 26-, and 40-day moving averages

Stephen Suttmeier

Nov 28, 2025

Glencore: Breakout and retest points higher

We received a request to look at the chart for Glencore plc. GLNCY shows a bullish breakout and retest from a February-September base. The immediate pattern stays positive above the 8.87-8.66 breakout and retest zone with upside potential to the 10.50s-10.70s, which is a confluence of projected resistance defined by the 100% extension (measured move), declining 200-week moving average, top of a rising channel, and a downtrend line from early 2023. Additional upside into the 1

Stephen Suttmeier

Nov 28, 2025

Silver's bullish cup and handle patterns

Bullish investors drink from cup and handle patterns. We recently highlighted these bullish setups for silver futures and the iShares Silver Trust (SLV) in this blog. The metal continues to trace out bullish formations that support both tactical and longer-term upside potential. Silver futures are attempting to break out from its mid October into late November bullish cup and handle pattern that would favor additional tactical upside to 62 (Chart 1). In addition, a solid clos

Stephen Suttmeier

Nov 28, 2025

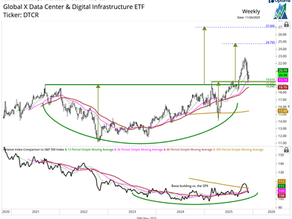

DTCR: Bullish breakout and retest pattern

Similar to the setup recently highlighted in the ARK Autonomous Technology & Robotics ETF (ARKQ) in this blog on Monday (11/24), the Global X Data Center & Digital Infrastructure ETF (DTCR) is also retesting a major bullish breakout zone. DTCR is retesting its bullish breakout from a late 2021 into late 2025 big base. We view the breakout and retest zone at 19.61-19.00 as a big support for both DTCR and the broader U.S. equity market since holding this key level would confi

Stephen Suttmeier

Nov 26, 2025

New 52-week highs point to rotation

In summary, net new 52-week highs improve as the S&P 500 (SPX) rebounds, but a key threshold remains. The SPX has staged a three-day rebound off Friday’s (11/21) intraday low of 6521, accompanied by an encouraging expansion in new 52-week highs relative to new 52-week lows—even with the index still below its late-October record of 6920. Recent editions of The Sector Edge have highlighted the ongoing rotation beneath the surface of the U.S. equity market. The improving spread

Stephen Suttmeier

Nov 26, 2025

Zweig Breadth Thrust

Question: I know you have talked in the past about the Zweig Breadth Thrust. I’ve seen a few saying we are setting up for one. Do you agree. What would it take for it to occur? Yes - we a monitoring the potential Zweig Breadth Thrust (ZBT) for NYSE stocks, which if completed could provide a bullish signal for U.S. equities. What Is a Zweig Breadth Thrust? Developed by Martin Zweig, the ZBT measures whether the market shifts from deeply oversold to strongly bought in a short p

Stephen Suttmeier

Nov 26, 2025

Relative strength vs. the SPX

Question: I wonder about your indicator about Relative performance SP500 index. Could you explain for me??? Great question. We will briefly address the relative price ratio versus the S&P 500 in this post and will plan on putting together a Tech Speak 101 on this topic in December. How to read a relative price chart A relative (or ratio) chart compares the price of a security relative to another. It is often used to identify a stock's relative strength or weakness versus a be

Stephen Suttmeier

Nov 25, 2025

ZROZ: A potential bullish shift

The PIMCO 25+ Year Zero Coupon U.S. Treasury ETF (ZROZ) shows a potential bullish shift on a breakout from a September 2024 into September 2025 falling (aka) bullish) wedge. ZROZ also shows a tactical breakout from a base off the May, July, and September lows. This breakout remains intact above 67.30-66.56, supported by improving 13-, 26-, and 40-week moving averages (ranging from 68.19 to 66.41), and projects near-term strength toward 73.60 (pattern count) and the March and

Stephen Suttmeier

Nov 25, 2025

GLD and SLV: Tactical bullish consolidations

The SPDR Gold Shares ETF (GLD) reached—and briefly exceeded—the 2011–2024 cup-and-handle breakout target at 377 in mid to late October. Since then, GLD has consolidated in a constructive manner, holding above its rising 40-day moving average (now 373.78) and carving out a potential tactical base anchored by the recent lows at 368.52 (11/17) and in the 361.39–360.12 zone from early November and late October. A decisive move above 388.18 would confirm this developing base and

Stephen Suttmeier

Nov 25, 2025

Dow Transports set for a bullish breakout

Rotation, rotation, rotation... The Dow Jones Transportation Average (DJT) shows bullish rotation (aka leadership) vs. the S&P 500 in November. An upside breakout and retest for DJT vs. the S&P 500 bode well for this bullish shift for the Dow Transports. Chart 1: Dow Jones Transportation Average (DJT) relative to the S&P 500 This bullish rotation occurs as DJT positions itself for an upside breakout from a July into November basing pattern. A decisive rally above 16,500 would

Stephen Suttmeier

Nov 25, 2025

KEYS attempts a post-earnings breakout

We highlighted big base breakout potential for Keysight Technologies (KEYS) in our November 7 The Stock Pulse . KEYS reported earnings after the close yesterday (11/24), and the stock is attempting a post-earnings breakout from its 2022-2025 big base. A decisive rally above 186.20-178.50 would confirm this big base to target 209 (December 2021 peak) and the 250s (pattern count). KEYS may be forming a bottom relative to the SPX, which would corroborate the basing process on th

Stephen Suttmeier

Nov 25, 2025

Charted Market Insights - Nov. 25, 2025

*** Please see the bottom of this report for important disclaimers and disclosures.*** SPX, NDX, bond bases, CQQQ, GXC, and palladium SPX: The "Trump Tariff Tweet" low near 6550 bent but not break As highlighted in our Straight from the Chart blog yesterday (11/24), key S&P 500 (SPX) support at the "Trump Tariff Tweet" low near 6550 bent but not break. The rebound from Friday’s low at 6521 establishes 6550-6521 as key support, but to avert the risk of a tactical head and sh

Stephen Suttmeier

Nov 25, 2025

Biogen (BIIB) and Intuitive Surgical (ISRG)

We received a blog question on Biogen (BIIB) and Intuitive Surgical (ISRG) - both of these Healthcare charts tilt positive. Biogen (BIIB) has rallied out of an 11-month base on the push above 160-157, which reverses its role from support from resistance. This breakout projects into the 203 to 210 range with the declining 200-week moving average a potential overhang at 212.81. Monday's (11/24) close at 176.82 is in "no-man's land" between the breakout zone and upside target

Stephen Suttmeier

Nov 24, 2025

ARKQ tests big base breakout point support

The ARK Autonomous Technology & Robotics ETF (ARKQ) is retesting its bullish breakout from an early 2021 into late 2025 big base. We view the 102-98 area (breakout/retest zone and the rising 26-week moving average) as a big support for both ARKQ and the broader U.S. equity market since holding this key level would confirm the big base breakout on ARKQ and point to an improving risk-on tone for U.S. equities. In terms of ARKQ, holding 102-98 keeps the big base breakout intact

Stephen Suttmeier

Nov 24, 2025

"Trump Tariff Tweet" low bent but not break

The S&P 500 (SPX) and other U.S. equity indices have had plenty of volatility in the wake of Nvidia's (NVDA) earnings print last week. Thursday's intra-day rally on the SPX stalled at a logical chart resistance defined by the weakening 13-, 26-, and 40-day moving averages (DMAs) now in the 6705 to 6754 range prior to forming a bearish engulfing candle and closing below the "Trump Tariff Tweet" low near 6550. However, Friday's rebound off an intra-day low of 6521 reclaimed 655

Stephen Suttmeier

Nov 24, 2025

The Sector Edge - Nov. 24, 2025

*** Please see the bottom of this report for important disclaimers and disclosures.*** Ranks and rotations plus XLF, IAI, KBE, XLK, and SMH SPX down last week: Eight sectors outperformed and three sectors positive The S&P 500 (SPX) dropped 1.95% last week, but eight sectors beat the market and three of these sectors rallied. Healthcare was the strongest sector, reaching another 52-week closing basis high on a 1.83% gain for the week. Staples and Communication Services were

Stephen Suttmeier

Nov 24, 2025

The Stock Pulse - Nov. 21, 2025

*** Please see the bottom of this report for important disclaimers and disclosures.*** Three bulls: ALLE, MMS, and STE. One bear: BSX ALLE, MMS, and STE show big bases as BSX struggles after bearish wedge Allegion (ALLE), Maximus (MMS), and STERIS (STE) each show constructive long-term technical setups, with ALLE breaking out of a 2021–2025 cup-and-handle base and targeting 195 and 210, MMS strengthening within a multi-year triangle base with breakout potential above 92.50

jennifer suttmeier

Nov 21, 2025

ABBV: Breakout/retest points higher

AbbVie (ABBV) has a bullish breakout and retest pattern as well as an improving trend with bottoming signs relative to the S&P 500. Staying above the breakout and retest zone at 219-211 along with the 38.2% retracement of the April-October rally at 214 would keep the pattern bullish for upside potential beyond the October peak at 244.81 toward the pattern count at 273. Chart 1: AbbVie (ABBV) (top) and relative to the S&P 500 (bottom)

Stephen Suttmeier

Nov 21, 2025

Margin debt hits another record high

FINRA data show that debit balances in customers’ securities margin accounts continue to climb. After breaking above the $1.0 trillion threshold in June, margin debt continues to push to record highs, reaching $1.184 trillion in October. The late-2021 to mid-2025 cup-and-handle pattern argues that this uptrend may not be over. Based on the pattern’s measured move, margin debt could rise toward roughly $1.260 trillion. Chart 1: FINRA margin debt Higher highs for margin debt ha

Stephen Suttmeier

Nov 21, 2025

bottom of page